Payroll is not easy to manage, especially when it comes to determining the number of hours worked by the employees. Have you ever asked yourself whether you are getting it right when it comes to dealing with hourly employees or even when calculating overtime? It is important to know how to calculate payroll hours properly.

In this guide, you’ll learn the steps to ensure you get it right every time. Whether it is tracking normal working hours or overtime and even breaks, you are sorted. Are you prepared to make your payroll process more efficient and keep things on track? Let’s dive in!

What are Payroll Hours?

Payroll hours are the total hours that your employees work and which are used to determine their wages. These include all the time an employee spends working, whether it is during normal working hours, extra hours, or any other time. Payroll hours are important to track as a manager because they are directly related to your payroll figures. Accurate tracking also helps to make sure that your team is paid fairly for the work they do, which helps to reduce any issues that may be associated with remuneration.

Why Tracking Employee Hours is Crucial for Accurate Payroll?

The following are the key reasons why tracking employee hours is crucial for accurate payroll.

- Ensure Payroll Accuracy: When you track your employee hours accurately, you can make precise payroll calculations. This means your employees are paid for the exact number of hours they have worked, which fosters trust and eliminates payroll mistakes.

- Avoid Pay Dispute: Proper documentation of the hours worked minimizes issues that may arise concerning the payroll. Employees have a clear record to refer to, which helps to avoid confusion and conflicts in the workplace.

- Comply with Legal Standards: When you track hours, you can make sure that your business is compliant with labour laws. This compliance protects you from legal risks, including fines or lawsuits, that may result from improper wage determination.

- Streamline Financial Management: When time is recorded correctly, it provides a clear picture of the amount of money that is spent on labour, which is useful in planning. This clarity helps you to manage your resources well and not be caught off guard by extra payroll costs.

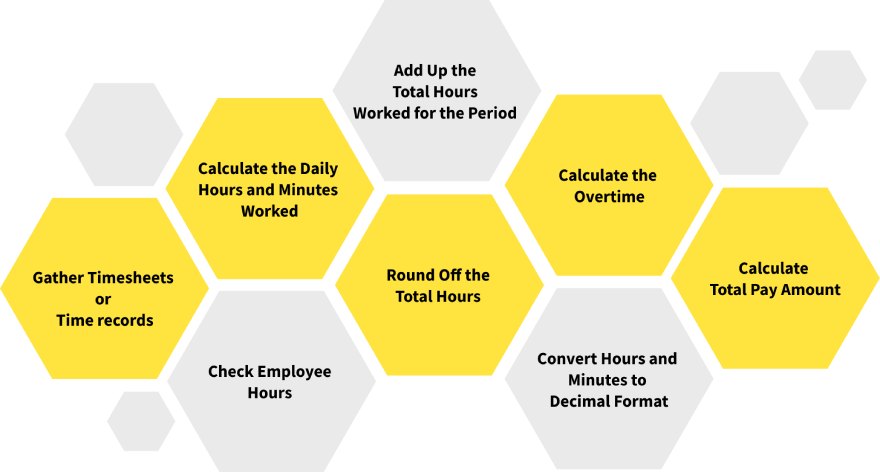

How to Calculate Payroll Hours Manually?

You may think that it is a daunting task to calculate the payroll hours manually but if you do the following steps, it is easy. To avoid errors, start by gathering all the timesheets you will use and then adhere to a strict procedure to verify and count the hours. Below are the steps that should be followed to make sure that it is done in the right manner.

Step 1: Gather Timesheets or Time records

First, gather all the timesheets or time log reports from your employees. Make sure you collect these documents for the whole pay period, which may be weekly, biweekly, or monthly. Every timesheet should contain correct clock-in and clock-out timings. Check these records to make sure they encompass all work days and any breaks or time off. It is very important to have correct and complete timesheets to have a correct payroll.

Step 2: Check Employee Hours

Review each employee’s timesheet to ensure that the hours recorded are correct and match your records. Look at the clock-in and clock-out times and see if there are any gaps or errors, for instance, if some employees’ records are missing or if the time is wrong. If there is any discrepancy, it is better to consult with the employee or correct the records before proceeding to the next step. Proper verification assists in preventing errors in the computation of wages.

Step 3: Calculate the Daily Hours and Minutes Worked

For each workday, calculate the total hours and minutes that each employee has spent at work. To calculate the total time worked for that day, simply subtract the clock-in time from the clock-out time. If there were any idle times or breaks taken, then this time should be subtracted from the total time taken. For instance, if an employee punched in at 9:00 AM and punched out at 5:00 PM with a half hour lunch break, then the total work time would be seven and half hours. This helps to make sure that you have well-defined daily working hours.

Step 4:Add Up the Total Hours Worked for the Period

After calculating the hours for each day, add these daily totals to get the total hours worked in the pay period. This step sums up the daily hours into a total for each employee in order to get a general view of the working hours. It is also important to include all the workdays within the pay period to avoid any discrepancies. This total will be used to calculate wages and overtime pay, and it will be the total number of hours worked by the employees in the company.

Step 5: Round Off the Total Hours

It is also important to round the total hours worked depending on the rounding policy of your company to standard rounding. Some of the practices include rounding to the nearest 15 minutes or rounding to the nearest 5 or 10 minutes. For instance, if an employee worked 7 hours and 37 minutes, and your policy rounds to the nearest quarter of an hour, this would be rounded to 7.75 hours (decimal form). Adhering to your company’s rounding policy to avoid favouritism and unfairness when paying employees.

Step 6: Convert Hours and Minutes to Decimal Format

To make it easier to calculate the payroll, it is necessary to convert the rounded hours and minutes into decimal form. This means that the hours and minutes are represented as a single decimal number. For instance, 45 minutes is equal to 0.75 hours. For instance, if an employee had worked for 8 hours and 20 minutes, this would be equivalent to 8.33 hours. The decimal format is more convenient to apply pay rates and to sum up the totals.

Step 7: Calculate the Overtime

Find out if there are any hours worked that can be considered overtime based on your company’s regulations or the country’s laws. Normally, overtime is any time worked more than 40 hours in a week. Determine the overtime pay by multiplying the overtime hours by overtime rate which is normally higher than the basic rate. For instance, if the basic rate per hour is $15 and the rate for overtime is $22.50, multiply the overtime hours by $22.50 to calculate the overtime pay.

Step 8: Calculate Total Pay Amount

Last of all, add the regular pay of each employee with the overtime pay to get the total pay. Add the product of the total regular hours and the employee’s regular hourly wage. Next, include the amount of pay for overtime hours. For instance, if an employee was paid $15 per hour for 80 regular working hours and $22.50 per hour for 10 overtime hours, their total pay would be $1,200 (80 hours x $15) plus $225 (10 hours x $22.50), resulting in a total pay of $1,425. This final amount is the employee’s gross pay or wage, which is the amount he or she earns before deductions and taxes.

With these detailed procedures, you are able to make fair and accurate payroll calculations, which are critical in the management of payroll and the satisfaction of employees.

Common challenges in calculating payroll hours:

When you are manually calculating the payroll hours, you may encounter several issues that may make the process to be challenging. Here are some common issues you might encounter.

Data Entry Errors:

When you calculate payroll hours manually, the chances of making mistakes when entering data are high. Such mistakes can lead to wrong pay slips and employee confusion. To prevent this, cross-check all entries and possibly have someone else go through the data. Payroll errors can be prevented by having checks and balances in place to detect mistakes before they occur.

Time Tracking Inconsistencies:

Some employees may use paper timesheets, others may punch in on a digital clock, and others may use their mobile devices. This can lead to disparities when you attempt to integrate the data. To avoid such discrepancies, ensure that the time tracking method used in your organization is same for all the teams.

Calculating Overtime:

Overtime calculations can be complicated because of the different rules and regulations that apply. There are likely to be differences in what is considered as overtime depending on the circumstances, and these may vary from one region to another. Know the company’s overtime policy and the laws of the state where the company operates. Ensure that you are calculating overtime hours and pay correctly to meet these regulations and steer clear of legal complications.

Handling Breaks and Absences:

It is often difficult to keep track of and account for the breaks and absences of employees. If not well managed, it can cause issues in the computation of the payroll. Establishing a break-time policy, along with a standard procedure for documenting breaks and absences, ensures consistency. Make sure this is followed by all employees to ensure the time taken for breaks and any absent days are accurately captured in the payroll. This helps maintain proper records and prevents discrepancies in payroll calculations.

Maintaining Records:

Payroll records are dynamic and need constant updates. The timesheets and other documents should be well arranged and updated at all times. It is also important to review and update these records from time to time to reflect the most recent information. Payroll records will assist you in the management of payroll and also ensure that you have easy access to past records in case of any need.

By getting to know about these challenges, you can take some measures to address them and make your payroll process effective.

Streamline your Payroll Calculation With Automatic Time Tracking Software:

Payroll management can be quite complex, especially when it comes to manual tracking systems. This is made easier by automatic time tracking software that ensures that all the hours worked are recorded in real time. This software is time-saving and less prone to human error when calculating the payroll since it does not involve manual entry.

Time tracking software automatically tracks the working hours of employees and other details like clock-in time, clock-out time, breaks, and overtime. This minimizes the chances of making mistakes and frees up your time that would otherwise be spent reviewing and correcting time entries.

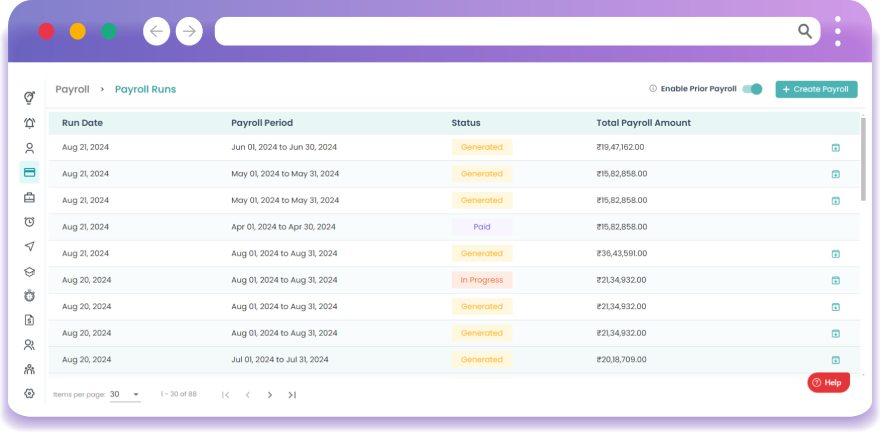

How Time Champ Can Help

Time Champ, an automatic time-tracking software with advanced features, simplifies your payroll calculations. When you incorporate Time Champ into your payroll process, you can track working hours, determine pay correctly, and meet legal requirements. Time Champ’s real-time tracking, seamless integration with your payroll system, and comprehensive reporting streamline payroll management and enhance accuracy. These features simplify payroll calculations and make it easier to get historical data when required.

Time Champ will help you eliminate manual calculations and embrace a more efficient and accurate payroll system. Simplify your payroll processing and guarantee your employees are paid correctly and on time with Time Champ.

What are the Best Practices for Calculating Payroll Hours?

Some of the best practices to follow in calculating payroll hours.

Use Reliable Time Tracking Tools

Introduce an efficient time tracking system that can automatically record the employees’ hours with precision. Accurate tools help in tracking all the minutes worked and this minimizes the chances of making mistakes. This system also assists in recording clock-in and clock-out times, breaks, and overtime without much difficulty, which is essential for accurate payroll computation.

Review and Approve Time Entries:

Before preparing the final payroll, go through each employee’s time records. This step entails verifying issues like wrong clock-ins, unauthorized overtime, or skipped breaks. This way, you can check the time entries before processing the payroll and correct any mistakes or anomalies that may be present, thus issuing accurate pay checks.

Stay Compliant with Labor Laws:

Know the legal regulations that concern wages, overtime, and breaks for workers in your state. Ensure that you do not violate any of these regulations when determining your payroll so that you do not end up paying penalties. Compliance does not only protect your organization from fines but also ensures that employees are paid fairly as the law stipulates.

Regularly Audit Payroll Processes:

Perform payroll audits periodically to address any potential issues. This practice entails the process of verifying the payroll reports and ensuring that there are no disparities and that all the computations are accurate. Payroll audits are important in ensuring that your payroll system is correct and that small problems do not develop into major ones.

Invest in Payroll and Time Tracking Software:

Select payroll software that is compatible with the time tracking software that you use in your business. Purchasing integrated software packages for tracking time and preparing payroll eliminates the need for manual data entry and thus, eliminates errors. This integration helps save time and increase in efficiency when it comes to the payroll.

Conclusion

Payroll calculations are critical to the effective running of the organization and the satisfaction of the employees. This approach allows you to track hours accurately and avoid mistakes or compliance problems by using effective time tracking and payroll software. Using good software helps in this by reducing the time spent on it while at the same time ensuring that everything is fair and accurate. Just bear in mind that good payroll management is equal to less stress for you and a more satisfied team.

Transform your payroll calculation process with Time Champ—try it now for effortless accuracy and efficiency!

SignUp for FreeBook DemoPayroll hours are the total hours that employees work, be it the normal working hours, the overtime, or any other hours worked that are used in computing the wages. Payroll hours must be recorded correctly so that employees are paid fairly and payroll figures are managed properly.

Proper recording of the employees’ working hours is crucial in determining the right payroll, avoiding disputes, and adhering to the legal requirements. It also helps in the financial planning and management of resources in the organization.

Time tracking software automates the recording of employees’ working hours and is efficient, accurate, and less time-consuming. It offers real-time data, guarantees accuracy, and can be easily integrated with payroll systems.

Payroll rounding of hours makes calculations easier and fair. Some of the practices include rounding to the nearest 5, 10, or 15 minutes depending on the company’s standard procedures.

To remain compliant, familiarize yourself with state and federal labor laws regarding wages, overtime, and breaks. Use tools such as time tracking and payroll to help in the compliance with these regulations.