What is Gross Income?

Gross income stands for the amount of

money earned or received by the

person or a company right before any

deductions or taxes are made. The

gross income is the total sum of all

incoming cash regardless of its

origin.

What is Net Income?

Net income is the word which is a synonym of net profit or net earnings. It refers to the income remaining after deducting all expenses, taxes, and other deductions from gross income. Net income is often used as a measure of profitability, as it reflects the amount of money a person or a company actually earns or retains after expenses.

Gross Income Vs Net Income

| Dimension | Gross Income | Net Income |

|---|---|---|

|

Definition |

Total income earned or received before deductions |

Net Income is the amount remaining after deducting expenses and taxes |

|

Individuals |

Includes wages, salaries, bonuses, tips, rental income, investment income, etc. |

After deducting taxes, retirement contributions, health insurance premiums, etc. |

|

Companies |

Includes revenue from sales, fees, services, etc. |

After subtracting expenses such as cost of goods sold, operating expenses, taxes, interest, etc. |

|

Purpose |

Provides a measure of total income |

Indicates actual profit or earnings after expenses |

|

Individual Example |

Suppose an individual’s salary is $60,000 per year, and they receive a $5,000 bonus. Their gross income would be $65,000. |

After deducting taxes, retirement contributions, and health insurance premiums, the individual’s net income might be $50,000. |

|

Company Example |

A company generates $500,000 in revenue from sales of its products. |

After deducting costs such as materials, labor, rent, utilities, taxes, and other expenses, the company’s net income might be $100,000. |

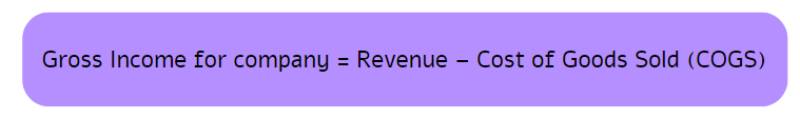

Gross Income Formula for Company

Example:

Let’s say a company has total revenue of $150,000 and its Cost of Goods Sold (COGS) is $50,000.

Gross Income = $150,000 – $50,000

= $100,000

So, the gross income of the company is $100,000.

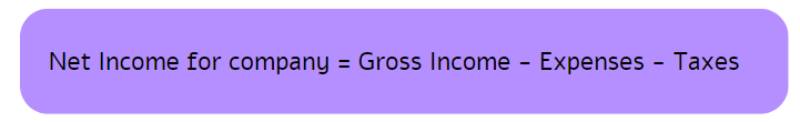

Net Income Formula for Company

Example:

Consider the same company mentioned above, with gross income of $100,000. Let’s assume its total expenses are $40,000 and it has a tax obligation of $10,000.

Net Income = $100,000 (Gross Income) – $40,000 (Expenses) – $10,000 (Taxes)

= $100,000 – $40,000 – $10,000

= $50,000

Therefore, the net income of the company is $50,000.

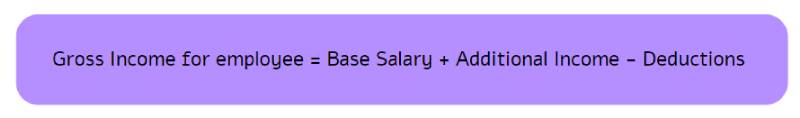

Gross Income Formula for Employee

Example:

Let’s consider an employee named Sarah:

- Base Salary: $60,000 per year

- Additional Income: Quarterly Bonus of $2,000

- Deductions: Health Insurance Premiums of $3,000 per year

Gross Income = Base Salary +

Additional Income – Deductions

Gross Income

= $60,000 (Base Salary) +

$2,000 (Bonus) – $3,000

(Health Insurance) Gross Income

= $59,000

So, Sarah’s gross income for

the year is $59,000.

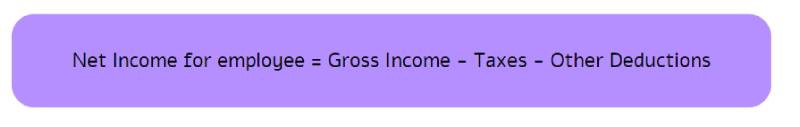

Net Income Formula for Employee

Example:

Let’s continue with Sarah’s example and assume she has tax obligations of $10,000 per year and other deductions such as retirement contributions totaling $5,000.

Net Income = Gross Income – Taxes – Other Deductions Net Income

= $59,000 (Gross Income) – $10,000 (Taxes) – $5,000 (Other Deductions)

Net Income = $44,000

Therefore, Sarah’s net income after accounting for taxes and other deductions is $44,000

Gross income is the total income earned by a person or company before any deductions or taxes. It includes all sources of income, such as wages, salaries, bonuses, investment income, and business revenue.

Net income, also known as net profit or net earnings, is the amount of income remaining after all expenses, taxes, and deductions have been subtracted from gross income. It is a measure of profitability.

Deductions from gross income to determine net income can include operating expenses, cost of goods sold, taxes, interest on debt, depreciation, and other necessary business expenses.

No, net income is not necessarily the same as taxable income. Taxable income is the portion of income subject to taxes after allowable tax deductions and credits have been accounted for.